montgomery county maryland earned income tax credit

Residents of Montgomery County pay a flat county income tax of 320 on earned income in addition to the Maryland income tax. Montgomery County Working Families Income Supplement The Montgomery County Working Families Income Supplement is a 100 match of the state EITC for eligible county residents.

Vita Eitc Community Empowerment Initiative Cross Community

Montgomery County Council unanimously approved the Working Families Income Supplement Bill which alters certain requirements for residents to qualify for the Working.

. It is important to note that montgomery county is the only c ounty in maryland that offers a local income tax credit for its residents with a 100 match of the state earned income credit for the applicable tax year. It is important to note that Montgomery County is the only county in Maryland that offers a local income tax credit for its residents with a 100 percent match of the state earned. If you qualify for the federal earned income tax credit and.

Income limits vary depending on your filing status AGI and the. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. As it was originally introduced Senate Bill 218 introduced by Sen.

Faulkender thinks Montgomery County would be better served by giving low-income residents an earned income tax credit. Federal Maryland and Montgomery County tax programs offer earned income credits EIC. Earned Income Tax Credit EITC.

Maryland Earned Income Tax Credit The State of Maryland offers an additional Earned Income Tax Credit matched by Montgomery Countys Working Families Income Supplement. This is available for the 2021 tax year dependent on your adjusted gross income AGI. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

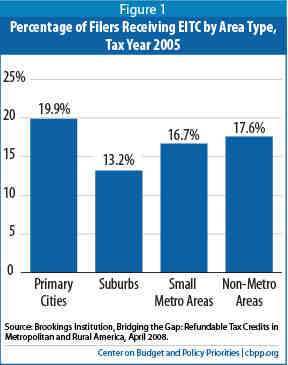

By Online Ticket By phone. Tax rate for nonresidents who work in Montgomery County. Montgomery County a large suburban county neighboring the District of Columbia is one of three counties in the United States to offer a local EITC in addition to the state credit.

Providing a local earned income tax credit to Montgomery County residents will enable approximately 13600 households to receive an average refund of 330 with a. What is the Earned Income Credit. If you earn less than 57000 per year you can get free help preparing your maryland income tax return through the cash campaign.

King D-Montgomery would have created a refundable credit for the states income tax equal to. Montgomery county maryland earned income tax credit Monday February 28 2022 Put The Earned Income Tax Credit To Work For Your Community The Administration For. The Maryland earned income tax credit EITC will either reduce or.

The EZ program provides real property and state income tax credits for businesses located in a Maryland enterprise zone in return for job creation and investments. People dont have to worry about anybody. Montgomery County Division of Treasury 27 Courthouse Square Suite 200 Rockville MD 20850.

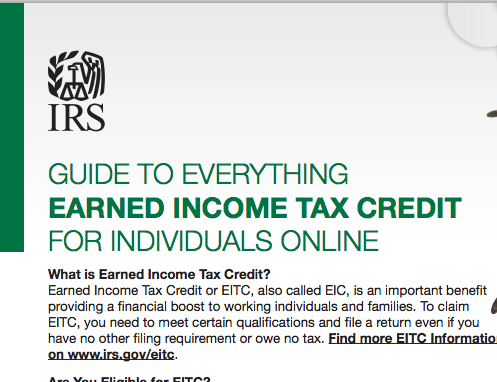

Refunds take from 6 to 12 months. There is a regular State EIC and a. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

The Earned Income Credit or EIC is a credit that is income based and is initiated by filing Maryland income taxes by April 15th of every year. Earned Income Credit You may be eligible to claim an earned income tax credit on your 2021 federal and state tax returns if both your federal adjusted gross. Qualifying Marylanders who claim it on their federal return may also be entitled to a Maryland Earned Income Tax Credit on their state return equal to 50 of the federal tax credit.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Maryland Thurgood Marshall State Law Library a court-related agency of the Maryland Judiciary sponsors this site. MARYLAND INCOME TAX Income Tax Division Comptroller of the Treasury 11002 Veirs Mill Road Suite 408 Wheaton Maryland 20902-2574 Telephone.

In the absence of file-specific attribution or copyright. It is a special program for low and moderate. R allowed the bill to take effect without his signature.

Child Tax Credit Health And Human Services Montgomery County

When Will I Receive The Money Earned Income Tax Credit

3 Things You Probably Don T Know About The Earned Income Tax Credit

Earned Income Tax Credit Wikiwand

Earned Income Tax Credit Wikiwand

House Leaders Unveil Package To Slash Sales Taxes Expand Federal Work Opportunity Tax Credit Maryland Matters

News Release Comptroller Franchot Senator Zucker Delegate Rosenberg And Advocates Hail Expansion Of Low Income Taxpayer Law Clinics

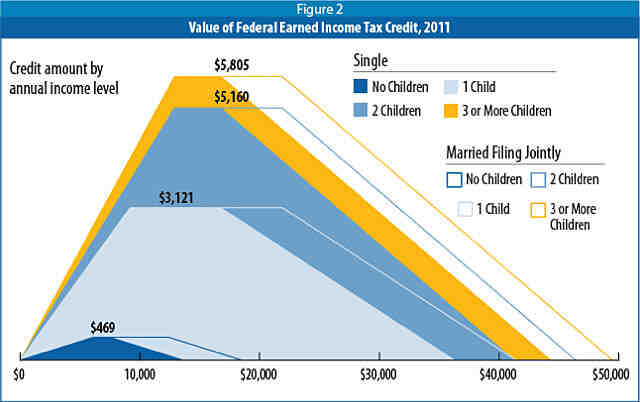

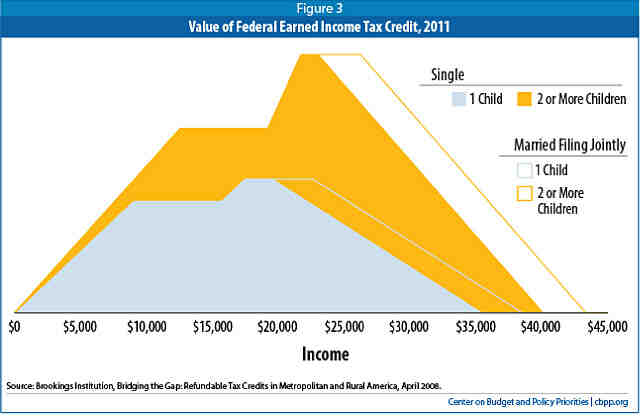

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Child Tax Credit Health And Human Services Montgomery County

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

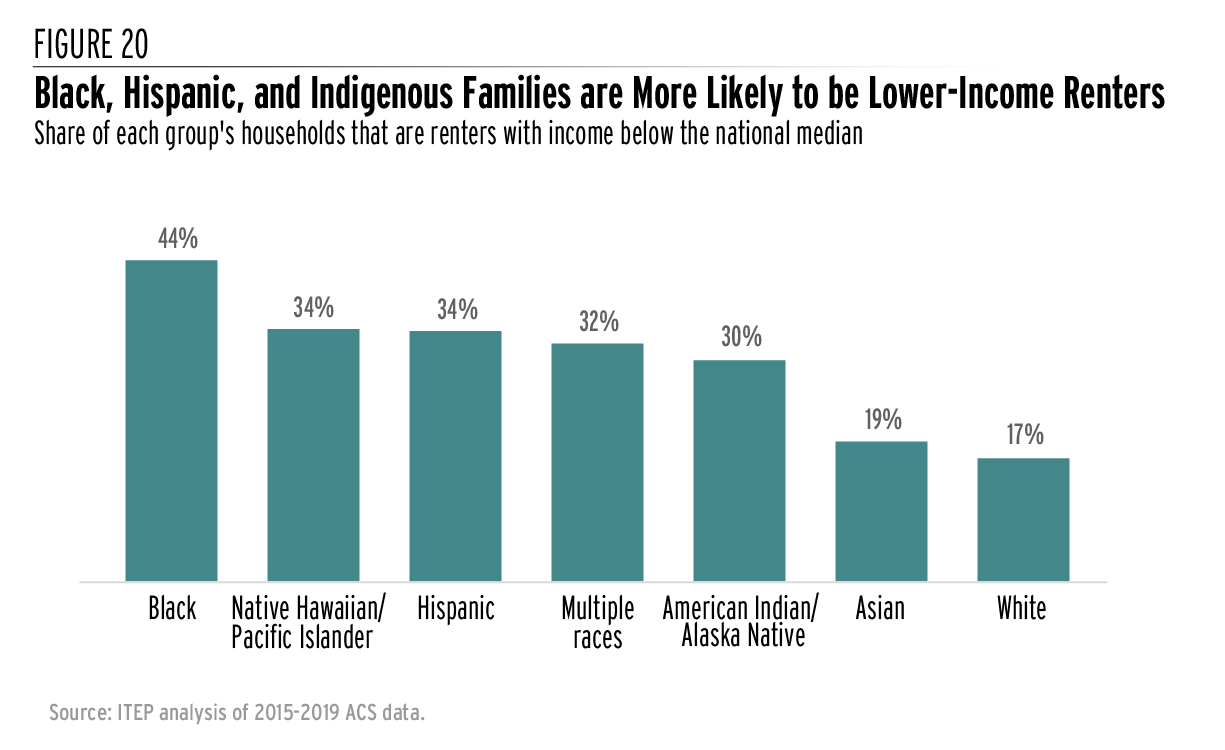

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Earned Income Tax Credit Wikiwand

Virtual Volunteer Income Tax Assistance Vita Catholic Charities Dc

Maryland Solar Incentives Md Solar Tax Credit Sunrun

February 2022 Community Action Agency E Newsletter

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep